Xero: Get prompt payment on the invoices you send

Small businesses are carrying billions of dollars worth of unpaid invoices. Those late payments put pressure on your cashflow and can cause a lot of worry. And yet, just a few simple steps could help you fix the problem.

Late payment happens – a lot

If you’re a small business owner, you’ve probably been paid late before. You’re not alone.

- Nearly two-thirds of Australian invoices are paid late.

- Local businesses are owed almost $12,000 each in late payments.

Late payment slows growth, reduces productivity and increases stress. It can lead to problems making payroll, difficulty paying bills, and increased borrowing.

Small business gets hit harder

Small businesses are regularly paid later than big companies and they have fewer cash reserves to cover the late income. You probably also have a harder time chasing debtors, because:

- You’re not scary

When your customers get a lot of bills at once, they will deal with the big guys first. Corporations have a reputation for enforcing penalties and referring unpaid invoices to debt collectors – so they tend to get paid before you. - You may not have an accounts department

Small business often don’t have a dedicated resource for chasing debtors. As a result, you won’t always know who owes you, or how late they are. And you’re probably not contacting those clients to follow up on payment. - You don’t have time

Chasing debtors takes time, and a lot of it. You have to check your books, find out what’s unpaid, and decide what to do about each outstanding invoice. Then you have to compose a well-thought-out email (or make a call) that treads the fine line between being polite and being firm. It’s a complete distraction from your core business. - You’re nice and there’s nothing you can do about that

You might find it hard to press late-paying clients for personal reasons. Perhaps you worry about bringing financial tension into a working relationship. It can feel awkward and uncomfortable, even if you know you have every right to be paid.

Prompt payment can be yours

Late payment isn’t a necessary evil. Businesses can and do get paid on time every day, and they achieve it through some very simple, practical steps that you can start taking tomorrow. Most are small tweaks to how you already do business.

1. Modernise your payment terms

Many businesses ask for bills to be paid within 30 days but that’s really just a tradition from the pay-by-cheque era. You may still have clients that pay that way, of course, but many will use instant payment platforms like electronic funds transfer or credit card. Set short payment terms and you’ll be surprised how many will settle their bill instantly.

Consider offering new customers invoice payment terms of 7 days (net 7). They may want to negotiate for more time – and you should try to be flexible – but starting off at 7 days will help set an expectation of prompt payment.

And remember that many debtors pay invoices at least two weeks after the due date. So if you actually need payment within 30 days, you should set your payment term to 14 days.

2. Create incentives for on-time payment

If you’ve been clear about your invoice payment terms and a customer has missed the deadline, you can charge a late payment fee. You’ve probably seen invoices with language like this: “Late fees are assessed after the due date, at the rate of 1.5 percent per month.”

Not surprisingly, late fees aren’t very popular with clients so you could get some kickback. A more positive approach might be to offer a discount for prompt payment. It doesn’t need to be much. The lure of saving money is a powerful motivator, even if it’s just a few percent discount. You can present it like this:

Total due: 4,022

Save 5% if paid by 7 December: 3,821

3. Itemise your invoice

List the details of the goods or services in a way that makes sense to the client. If they have to contact you for clarification, you could miss the payment window and be forced to wait for the next ‘cheque run’.

Be sure to include:

- a description of the work or product you sold

- the date the work or product was delivered

- the quantity of product or hours of service involved

And don’t forget to state:

- your payment terms (how long the client has to pay you)

- the invoice due date

- any prompt payment discounts or late fees

Some clients will have very specific requirements for the details you include on the invoice. So ask up front. It’s important housekeeping that could make a big difference to your cashflow.

4. Invoice quickly

Your client can’t start to process your bill until they have it, so get your invoice into their system as soon as you can. It’s good for them to receive it while your work is still fresh in their mind. Your admin will be smoother, too. You can finish the work, send the invoice and close the job all at once. There’s less chance you’ll forget to send the bill.

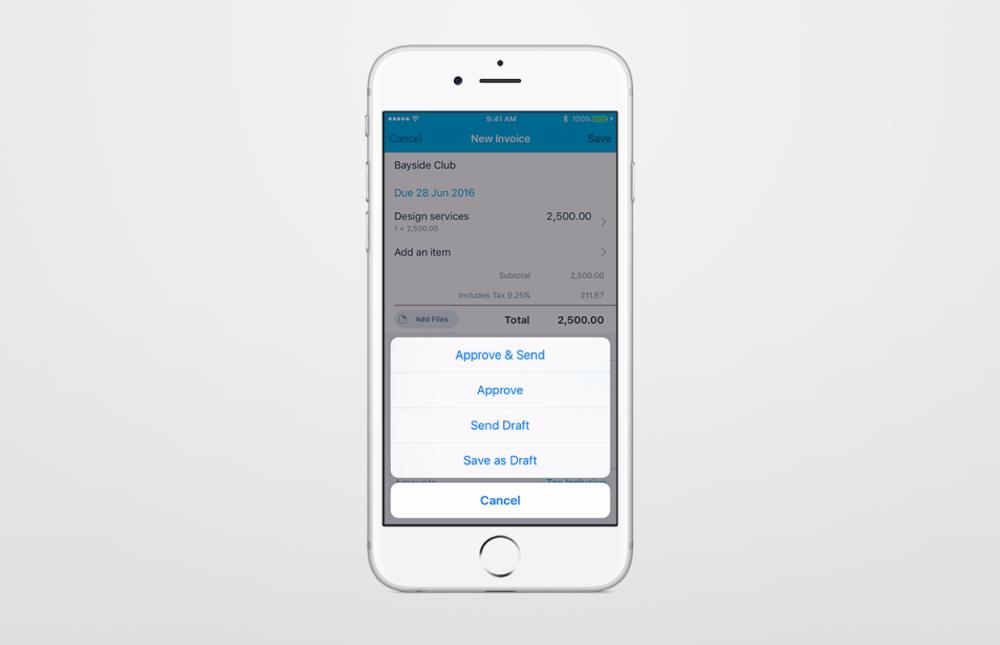

Nowadays, you don’t have to wait until you’re back in the office to invoice. With the right business software, you can send invoices from your phone.

Start sending invoices from your phone

5. Chase payments

This is the advice you didn’t want to read. In small business, you can’t assume invoicing is done once the bill is out the door. You’re going to have to follow up and make sure the debtor’s processing it.

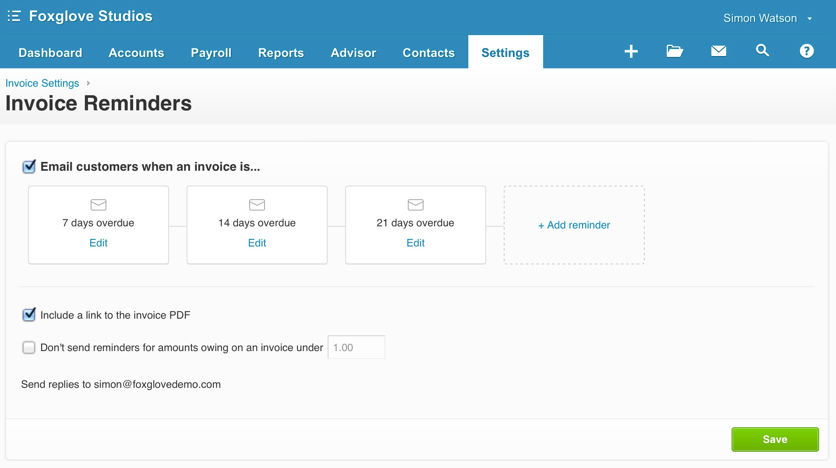

But this is where you can get really smart. Smart business software will chase the debtors for you. In fact it will do everything, including:

- sending your invoice electronically

- reporting back when the invoice has been opened

- telling you whether it’s been paid or not

- alerting you when the due date is approaching, and sending a reminder to the client

- warning you when payment has been missed, and sending follow-up emails to the client

You can decide how to escalate late invoices by presetting different messages to be sent out at each stage.

At a certain point, you’ll want to make a call. The smart systems will tell you when to do that, too, pulling up the client’s payment history so you can have an informed conversation.

Affordable automation

At about $50/month, these sorts of systems only need to save you about 15 minutes a week to pay for themselves. In reality, they’ll probably save you hours. Plus they’ll help you get revenue in the door, which could completely change your cashflow outlook.

As a bonus, invoicing software is often also accounting software. So for no extra charge, you get a bunch of other tools for tracking money in, money out, and helping handle your taxes.

Prompt payment is in your control

It’s no fun chasing debtors and it’s probably not what you’re good at. Yet it’s part of life for most small business. Unfortunately, you can’t – and shouldn’t – rely on your clients for prompt payment.

However, you can take control of the situation with just a few changes to how you invoice. These steps will improve cashflow and, if you automate them, your late payment headaches will diminish. You’ll spend less time chasing money and more time making it. The choice will be yours.

Article sourced from: https://www.xero.com/au/small-business-guides/invoicing/prompt-payment/